You know the best way to avoid debt is to have money in your savings account. But it feels impossible to fund a savings account when you’re barely making ends meet.

I know how it feels because I’ve been there, and because my clients roll their eyes at me whenever I talk about the importance of saving money for the proverbial rainy day. I can almost hear them thinking, there is no way I’m going to be able to put away any money on my salary!

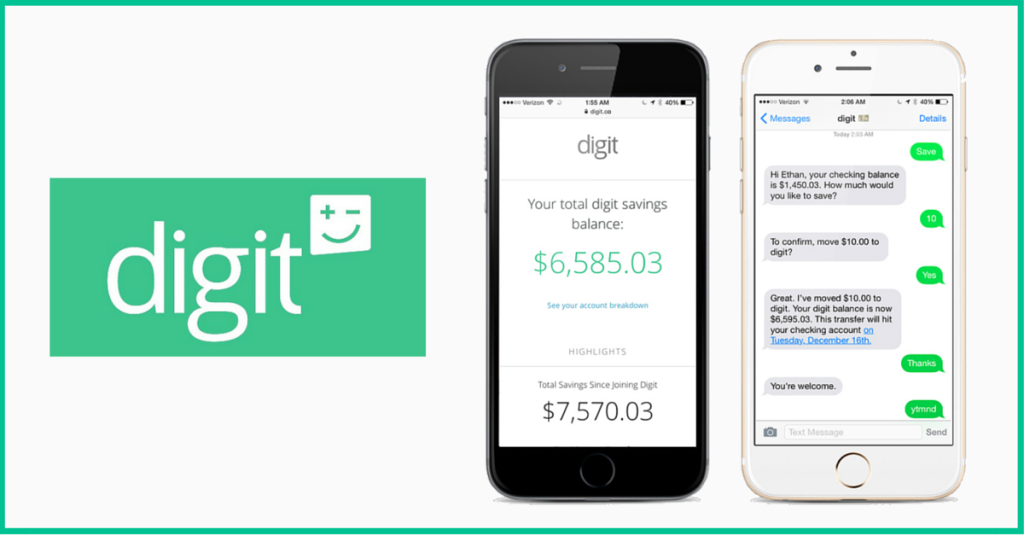

That’s why I was excited when I first heard about Digit, a free service that helps you save money by looking at your income and spending, finding small amounts of money it can safely set aside for you in a separate savings account.

To use Digit, all you do is sign up and connect your checking account. From there, it’s supposed to analyze your spending patterns and start automatically saving you money.

Too Good to Be True?

As good as Digit sounds, I was skeptical.

It seemed too easy to let the application worry about my savings and make decisions based on an algorithm. What if someone was barely scraping by financially – would Digit be able to accomplish anything?

I was also nervous that it would overdraft someone’s checking account and leave them saddled with fees and bounced checks. Most of the people I work with don’t have a lot of wiggle room in their budgets, and an overdraft fee could cause a domino effect of financial ruin.

Digit has a no-overdraft guarantee, which means it shouldn’t ever overdraft your account. If it does, Digit will reimburse you for the overdraft fees.

But if Digit was the real deal, I owed it to myself and my clients to learn about it. With that in mind, I signed up to check it out.

Dipping a Toe Into the Digit Pool

I didn’t want to risk much on my experiment so I connected Digit to a checking account I rarely use. Making random deposits and withdrawals each week, I was looking to trick the system into making a mistake.

If the account was overdrawn, it wouldn’t cause any problems with my finances. And given the fact that my test account was reflective of someone with a tight financial situation, Digit would need to have a robust algorithm in place to find savings.

It Won Me Over, Big Time

After two months it was clear that Digit was doing something right.

My test account never went into negative balance range, and my Digit savings account slowly began to grow. $5 here, $7 there – the numbers were small enough that I didn’t miss the money, but it added up.

Even better was the fact that I hadn’t done a thing. Digit did it all for me, automatically and without any involvement on my part.

Satisfied, I connected my main checking account to Digit and sat back to watch the results.

The results have been impressive. I’ve seen my savings grow without any involvement on my part, and never once have I missed the money deducted from my checking account.

Each morning I receive a text message with my checking account balance, which helps keep me up to date on how much I’ve got available in my account.

Whenever Digit makes a transfer, it sends me a text message with the amount of the transfer as well as how much I’ve got in my Digit account. If I want to view my Digit savings balance at any time, all I do is text SAVINGS to Digit and it lets me know.

In fact, there’s a whole list of text commands to help me manually transfer money to savings, view upcoming bills, review recent checking transactions, pause my savings, and even make a withdrawal from my Digit savings account.

When you want your money, just text WITHDRAW to Digit. There are no fees or limits to your ability to withdraw money, and it will show up back in your checking account the next business day.

I Love Saving Money By Mistake

My Digit account won’t fund your retirement, and it won’t help you save for a trip around the world.

What Digit will do is jump start your savings efforts even if you’re not making a lot of money. By taking small amounts from your checking account, Digit makes sure that you don’t realize you’re putting away money month after month.

Before you know it, you’ll have enough for a vacation with your family or a few extra payments towards those nasty student loans.

In the end, you’ll be more financially secure and start feeling the satisfaction of knowing you finally have that elusive cushion of money to help you get through life’s unexpected twists and turns.

My opinion? A total no-brainer. Give it a try and let me know what you think.

One thing – when you click the links in this article to go to Digit, I’ll get a $5 bonus if you sign up. It doesn’t cost you anything, but it’s the company’s way of thanking their customers for letting other people know about it. If you don’t want to use the links in this article, just click here to sign up on your own. Either way, you should try it out and see if it works for you.