People file for bankruptcy protection for a number of reasons: overdue credit card debts, tax obligations, mortgage issues, and more. One benefit of filing for bankruptcy is the ability to modify the terms of your car loan and pay it off through a court-ordered repayment plan.

If you’ve got a car and want to handle a particularly difficult car loan, you’re going to look to a repayment plan under Chapter 13 of the US Bankruptcy Code. Depending on your situation you may be able to reduce your interest rate, lower the balance of the car loan, or both.

Using Bankruptcy to Reduce the Car Loan Balance

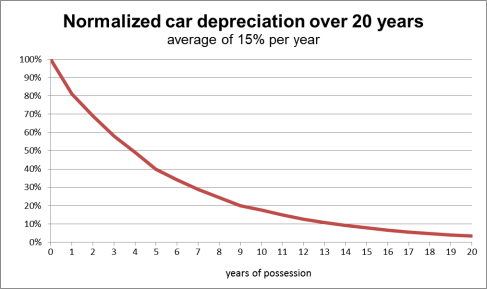

As the chart below shows, an average automobile loses half of its value in the first four years of life.

With low down payments required for most new car loans, it’s easy to see how the loan balance can easily exceed the value by a long shot. Under certain circumstances, you may be able to reduce the balance on your car loan to the current value. Given the fact that most cars aren’t worth nearly the amount due on the loan, this could end up saving you a lot of money.

The bankruptcy law allows you to achieve this huge money-saving result if:

- the car loan was a refinance of another car loan, or if the vehicle merely secures another personal loan; OR

- the outstanding loan was taken out more than 910 days before you file for bankruptcy; OR

- the vehicle is used for only business purposes or is driven by someone other than you.

If your situation matches up with any of these conditions then you will be able to bring down the balance on the car loan. Even if you don’t qualify to do so, there’s still one more way to save money using the bankruptcy laws.

Lower the Interest Rate with Chapter 13 Bankruptcy

Even if you can’t lower the balance of the car loan, Chapter 13 bankruptcy gives you the right to modify the terms of the promissory note between you and the car lender. If you’re paying a high-interest rate on your car, this could end up saving you thousands of dollars.

Just how low does the interest rate go? Way down. As in, the interest rate on your vehicle loan can be lowered to 1.5% above the prime rate.

If you’ve got excellent credit you may not be paying a high interest rate. Most people struggling to get out of debt, however, may not have the best credit score – and that usually translates into a high-cost vehicle loan.

When you go into a repayment bankruptcy, you can reset the interest rate using a formula established by the US Supreme Court in the Till case. In that case, the Court took the prime rate of interest and added an extra 1.5 percent premium to account for the lender’s risk of nonpayment.

You can find the Wall Street Journal prime rate here. The prime rate was 3.25% as of October 2015, which translates into a Till rate of 4.75%.

Consider how much you’d save on your car if you walked into bankruptcy with a 10% vehicle loan and were able to walk out with a rate of 4.75%. That leaves a lot of money left over for paying student loans, balancing your household budget, and starting to invest for retirement.

Get Your Title After Bankruptcy

Regardless of the benefits of using bankruptcy to modify your car loan, you’re still going to need to pry the title from your lender’s clutches. The bankruptcy court doesn’t have your car title, nor does the trustee assigned to divide your repayment funds among your creditors.

It may not be easy to get your title from the lender, but take these 5 simple steps to make the process as smooth as possible:

- Get hold of a copy of the Proof of Claim filed by the car lender in your Chapter 13 bankruptcy case. This will show the balance due on the car as of the date of the bankruptcy filing.

- Obtain copies of the Chapter 13 Plan and Confirmation Order. These documents, when taken together, will show the amount you proposed to pay as well as the judge’s Order that those payments were sufficient.

- Fetch copies of all motions filed in your bankruptcy case in connection with the car. That includes any motions made to reduce the interest rate, the loan balance, and motions made by the lender to lift the automatic stay. These will prove that your payment stream was backed by logic and the balance due on the loan.

- Obtain a copy of the Trustee’s claims register. This shows how much the trustee paid out during the bankruptcy.

- Get a copy of the bankruptcy discharge. This document proves that you made your Plan payments and the case ended satisfactorily.

You need to contact the lender directly to get your car title after bankruptcy. If they give you any hassles, go through the above steps and provide the lender with all the information they need to prove you’re entitled to your car title.

In the worst-case scenario, you may need to get the court to force the lender to give up the vehicle title. But considering the savings, it’s a small price to pay.