Student loan lawyers love IBR, or income-based repayment. When it comes to federal student loans, nothing provides more flexibility than a repayment plan tailored to your ever-changing income.

Made less money last year? No worries, your federal student loan payment will go down.

An income rebound means the payments will rise, but never more than the standard 10-year repayment amount.

Even better is the fact that your unpaid balance is discharged after 25 years of payments (less if you qualify for Public Service Loan Forgiveness).

There are a number of online calculators out there, but the formula is so easy you can handle it with a piece of paper and a pen and these four steps.

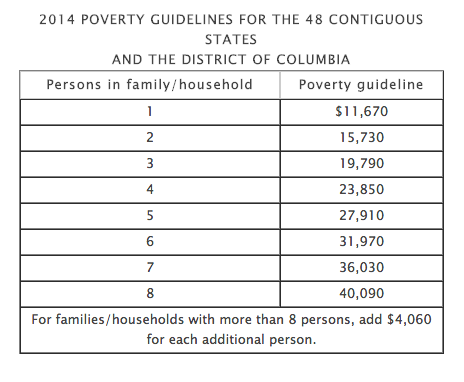

Look up the poverty level guidelines for your family from the Department of Health and Human Services website. For 2014, the poverty levels for the 48 contiguous states and the District of Columbia are listed below.

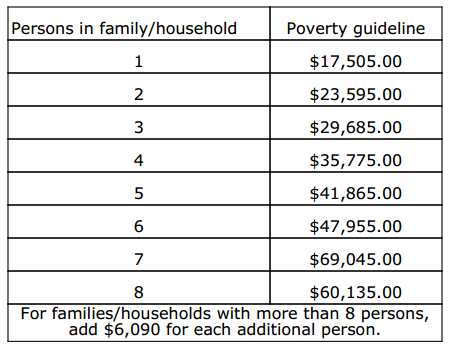

Multiply the appropriate poverty guideline by 150%. To make it easier, here’s the number to work with:

Subtract your adjusted gross income from the number you calculated in the previous step. Your adjusted gross income is the last line on the first page of your IRS Form 1040.

Take this number and multiple it by .15, then divide by 12.

The resulting number is your monthly IBR payment. If the IBR payment amount is less than the amount you’d be required to pay under the standard 10-year repayment plan, you will qualify for income-based repayment.

This is only the starting point, however. If you’re married then you need to figure out if it makes sense to file taxes separately from your spouse and how to apportion your dependents.

If you’re in default on your federal student loans then you’ll need to get that situation resolved through either rehabilitation or consolidation before you can opt for income based repayment.

It’s a complex process, but once you take control of the situation you’ll find that your life improves significantly.